Deed

Consideration

The term Consideration amount is used to describe the value of a transaction or transfer agreement between two or more parties. In other words, it is either a payment of money, the discharge of debt, the performance of services, or other values, that one party give the other party (e.g. from Grantee to Grantor) of the transaction. In real property law, an individual who sells or transfers title in real estate property to another buyer, recipient, donee is known as the grantor .

Often real estate property is transferred with or without consideration. However, when the real estate is sold to a third party e.g. grantee etc. the contract most the time will require the buyer to pay a consideration amount to the seller. In addition, the sales contract requires the seller to sign and deliver a deed (e.g. Warranty Deed etc.) as consideration to the buyer. This results in the buyer's obligation to pay the property sale price and the seller's obligation to sign and deliver the deed.

If money is changing hands a part of a real estate sale or transfer, deeds will usually list the actual purchase price of the property. Thus, transfer amount and consideration amount are the same. The following consideration could be listed on the deed and that value or amount might not correspond to the actual consideration or sales price paid for the property. There are common choices for listing consideration in the real estate transfer context:

- Nominal Consideration – Most deeds recite nominal consideration (e.g., “the sum of $10.00”). This keeps the actual consideration private and is common practice in most states

- Gift – If the property is a gift, there is no consideration. A Gift Deed may state that the property is being transferred “for love and affection” or something similar. In states with documentary transfer taxes based on the amount of consideration (including Florida and California), specifying that the property was a gift can save transfer taxes

- Actual Consideration – Actual consideration is sometimes used if the parties want to publicly document the purchase price paid for the property. However, since most states do not require that the actual consideration be listed, most deeds recite nominal consideration instead of actual consideration

- Capital Contribution – If property is being transferred to a business, the consideration received in exchange for the interest is often capital in the company. For example, a transferor might receive 1,000 shares of stock in exchange for the real estate being transferred to the company.

Many of the following real estate transfers e.g. those made for estate planning purposes are often made without consideration to the transferor:

- Transfers to a revocable trust for estate planning purposes

- Transfers between spouses or to family members e.g. children, heirs

- Transfers made under a settlement agreement or divorce decree

- Transfers from a deceased person’s estate

- Transfers made to capitalize a business entity, such as a corporation or limited liability company

Transfer without a money exchange, or what is called are often completed via a Quitclaim Deed to transfer title to the real estate. A deed is not a contract between seller and buyer to sell real property, but rather, it is the fulfillment of the transferor’s intent to transfer the property. Since a deed is not a contract, deeds in various states do not require a deed to show a consideration amount. In order to avoid any title disputes, it is recommended for the deed to recite at least a nominal amount of consideration (usually $10.00), even if no money changes hands.

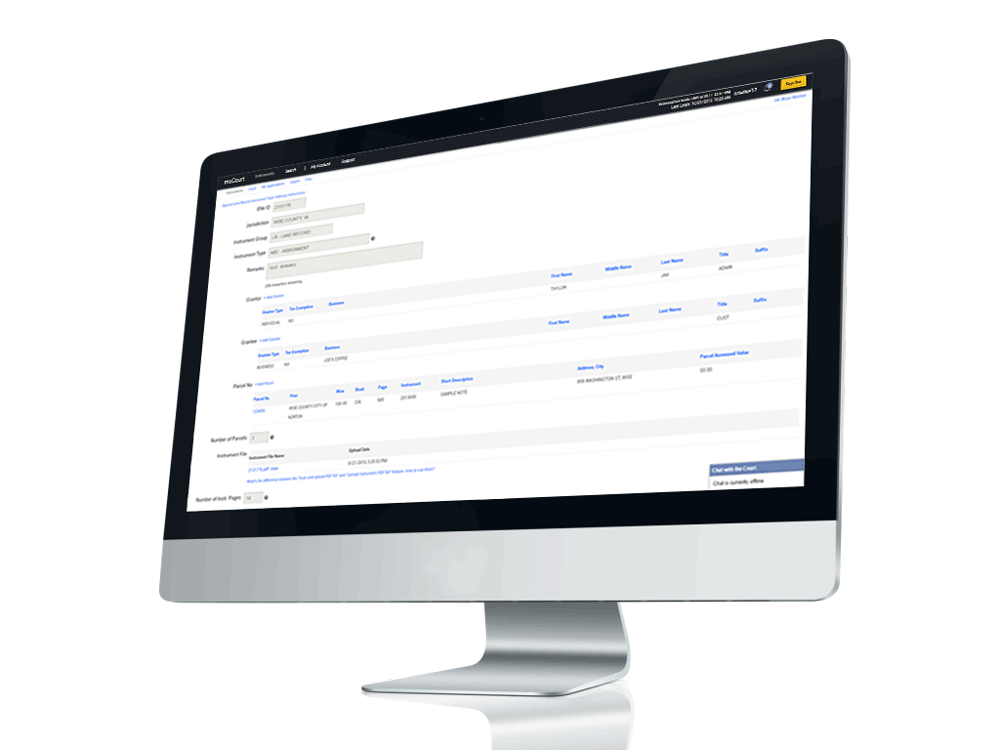

An overview of the Mixnet mxCourt Application